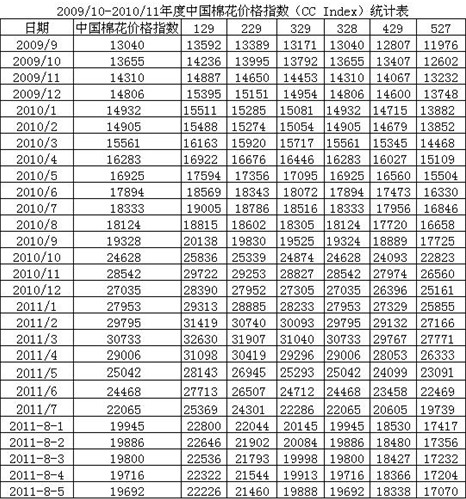

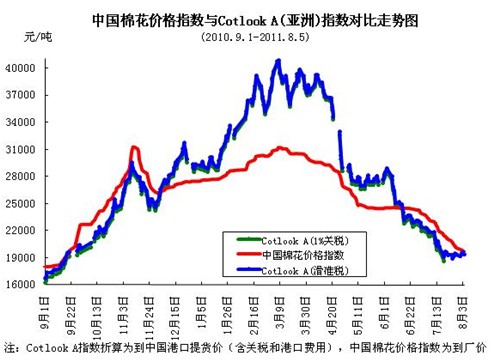

Last week (8.01-8.05) domestic cotton spot price level 3 below national ShouChu price 19800 yuan/ton, because enterprise hold down prices, cotton yarn purchasing cotton yarn price continue to fall, enterprise production effects of restricting output increases gradually, and high temperature, the whole market off-season continued weakness. Cotton procurement not much, still in business for sales have to continue to cuts, some firms have started to repair the machine, ready for New Year's takeover. According to our latest survey shows that the New Year is expected to yield 7.25 million tons, with 16% caliber. This week China cotton price index (CC Index328) week average 19808 yuan/ton, a QianZhou fell to 677 yuan; Level 229 21749 yuan/ton, fall 911 yuan; Level 527 17256 yuan/ton, fall 740 yuan. Last week the electronic set peatlands decrease a storehouse, center of gravity continue to dip.

A, domestic spot: industry is facing serious moment, as new annual production 7.25 million tons.

On behalf of the domestic cotton last week spot price of Chinese cotton price index fell below national ShouChu policy reserve price 19800 yuan/ton, spot the actual transaction price is much lower, enterprise in order to at a lower price, delivery, however, the lower the cotton prices more no one bought, cotton enterprise is tears. Due to increased port, the cotton spot on cotton imports cotton and domestic are not two phase, India exports, and finally the two sides reach a deal smooth, export will regain turnaround. According to understand some of the enterprise is ready to repair the machine, meet the new annual purchase. Textile enterprise, and the lower price purchasing cotton yarn, cotton prices are still falling, cotton same spot price also continue to fall. A few days ago, the report forecasts of cotton textile industry this year will be the end of "gold period" the turning point of the year, a group of cotton textile enterprise have to stop production or collapse, the cotton industry situation than the financial crisis even serious and complex. On Thursday, the national development and reform commission economic and trade company called the relevant departments ShouChu held ready to work conference, stressed that showed this year listed, according to market changes, timely temporary ShouChu plan, will start in accordance with the BiaoZhunJi ginned cotton 19800 yuan/ton of ShouChu price, ShouChu open. This to market with certain positive signal, but the meeting did not point 2010's cotton do, though on the market at present is not much, but the cotton market perspective, 2010 year last month, and still sell cotton difficult parts now investigating the Yellow River basin, some cotton farmers in hand, how much data being the number.

According to this July cotton production in July, according to the survey, the light, temperature, water over the conditions around enough, soil moisture content is appropriate, remove drought in hunan, jiangsu, anhui jianghuai region appeared flood outside, xinjiang and the Yellow River remained high temperature. From the 13 of the province of cotton, according to the survey of 2011 is the annual cotton cotton area of 81.34 million mu, is this net 2010 annual cotton planting area of 77.02 million mu, an increase of 4.32 million acres, 5.6%, is expected to produce 7.25 million tons, with 16% caliber.

Second, electronic set: peatlands decrease a storehouse, continues to move down.

Last week (8.01-8.05), the national cotton trading market ShangPinMian electronic business set 73340 tons, compared to the previous JiaoYiZhou volume increase of 14600 tons. Weeks decrease of 11860 tons, the total quantity order for 88000 tons.

This week has the following characteristics: a chip, clinch a deal amount, the average daily snapshot increased volume of 14668 tons, and average daily trading volume a week before an increase of 2920 tons, still have a snapshot, less than ten thousand tons, volume 2 days after turnover in twenty thousand tons more, maintain this week on September, October and December contract is decreased, the volume of last week, the guys MA1111 contract to clinch a deal for the biggest increase tons; Second, a new order, except for the distant months to reduce MA1201 contract small increase quantity contract outside, other contract order than a week before decreased, which in recent months MA1108 contract order, spot prices continue to pay cut the biggest decline of the markets continue to despise; Three, a new set of six contract all valence to continue falling, fall in the picture is in 329 459 yuan between, plate MA1112 above 20980 yuan, the lowest price for contract MA1109 and MA1111 contract 19510 yuan; Four, this week MA1108 contract 19834 yuan, higher than average week from CC Index328 level cotton 26 yuan/ton, concerning the spot price are basically the same.

Three, international market: a New Year, economic concerns MianJia crackdown

The first New Year period by buying ICE cotton support, the breakthrough key resistance, the high in two weeks. However, lack of cotton rise support disk concussion more, market then the economic outlook and the concerns of the demand, leading to the commodity futures market and the stock market fell overall, the fall of cotton. Friday in Europe in Italy and Spain, the European debt crisis debt problem again with the global nerve, traction debt caused credit rating, global commodity market and the stock market weekend weaker again, and drag of ICE fall. Cotton synchronous This week, ICE period cotton recent week average 104.73 cents per contract is up a week before pounds, 3.35 cents per lb; International cotton spot price for the same period Cotlook A index weeks 115.32 cents/pounds, average price is up 1.24 cents A week before/pounds.

Four, the market outlook

Economic statistics, will be announced tomorrow in July, macro economic data on the market at present many agencies report forecasting, and in July the CPI will continue in more than 6% in August, the market is expected to have another interest rate hikes. International, though the United States in the final hour reached debt upper limit, but the weekend s&p cut the long-standing U.S. credit rating, welcome the market panic, the global economy could have two of the United States, and QE3 agent can launch caused more and more questioning voice. This weekend, the euro area not calm Europe has the third largest economy Italy and Spain's debt problems caused concern, a and Greece have let the eurozone burned, if add to Spain and Italy will be even more alarming.

Domestic aspects, yuan appreciation, higher labor costs, export orders fell, part of the terminal consumption transferred to cheap labor force of southeast Asia, and other countries. So now the country can cotton industry is still around, and bad news can produce period, predict showed showed listed prices continuing to fall after the market.

Source "the Chinese textile nets"

Edit: lara